Automating Repair Estimates for Insurers using AI | Inspektlabs

There are millions of auto claims filed in the U.S. annually. Insurance companies can reduce the time and cost associated with the claims process by leveraging AI for repair estimation.

This post will dive into how AI-based insurance claims solutions can automate repair estimations for automotive insurers. We will begin by establishing a fundamental understanding of repair estimation and its relevance for auto insurers.

Then, we will discuss how AI-based estimations function and the models that insurers rely on to achieve their goals. Then, we will discuss the associated limitations and how Inspektlabs is trying to push the boundaries by tackling them.

Before concluding, we will briefly consider a typical AI-based workflow for insurers and the impact they have created.

Introduction

AI-powered technologies are rapidly carving a space for themselves in the automotive sector. Artificial intelligence is abundant in the industry, from connected cars to autonomous driving.

Automotive insurance is no exception because there are many sweeping changes happening that have revolutionized the traditional workflow. Insurers are now pivoting to AI-based inspection frameworks from damage detection to claim estimation. It is vital to comprehend the different elements of the insurance process before we can understand how AI is making a difference.

Auto insurers benefit significantly from incorporating AI in their workflow because it offers many cutting-edge advantages. In some detail, let us now explore these advantages and the fundamentals of AI-based repair estimation.

What Is A Repair Estimate, and Why Is It Essential For Motor Insurers?

When your car requires repairs, you may not have the money to pay for the repairs upfront. If you were in a car accident and had insurance coverage, you must inform your insurance company to make a claim.

The insurance company will generate an estimate for the cost of the repairs. The repair estimate relies on two different parties: a body shop's certified repair appraiser and an insurance company's auto appraiser.

The body shop's role is to estimate the repair cost, and the insurer's role is to determine how much of the repair you can claim. You may also have to choose between using OEM or lower-cost aftermarket parts.

Auto repair costs vary greatly, so you should always know that the total cost of your repairs could be high. If the damage estimate suggests that it will not be economically feasible to repair the car, your insurer will write off your vehicle. So, the fate of your car often relies on these repair estimates. Therefore, it is critical to gain a comprehensive understanding of the factors that impact it.

Unraveling the Complexity of Repair Estimates

Generating a repair estimate can be an incredibly complex task. There are many moving parts throughout the process, and a lot of subjectivity exists in the traditional framework.

Before we delve into how AI-based claims tech is transforming the conventional framework, let us consider the different aspects of repair estimates that make them so complex.

- Repair Estimates are Negotiable - Motor insurance repair estimates are usually negotiable. The insurance company negotiates with the repair shop to agree on the cost. Insurers may get a low bid to see if the claimant accepts it. If the estimate is low, ask for an explanation.

A good insurance adjustor will be willing to negotiate and may have a shop in mind that can complete specialty work. The uncertainty around repair estimates and their discrepancies with an insurance claim is a significant pain point for claimers. The traditional repair and claim estimation approach rely on human judgment, which is subjective and thus riddled with inconsistencies.

- Repair Estimates Rely On The Actual Cash Value - The Actual Cash Value (ACV) of a car refers to the price of the vehicle minus the depreciation of the car over time. Most cars depreciate after leaving the dealer's lot. Motor insurance companies base their repair estimates on the ACV, which can be hundreds of dollars lower than the vehicle's original purchase price.

You can negotiate the estimate with the insurance company if your car is worth more than its ACV. Otherwise, you may need to accept the insurance company's offer. If the insurance company cannot settle for the amount you want, you can dispute the amount. To do this, you must present the insurance company with comparable vehicles of the same model, trim level, and condition as your vehicle.

You can use online marketplaces, the Kelley Blue Book, or a Carfax report to do this. The introduction of such digital marketplaces is helping enhance the customer experience associated with this facet of an insurance claim.

- Repair Estimates are Subject to Inter-Company Arbitration - Motor insurance claims that are subject to a dispute go through Intercompany Arbitration. Under this process, the insurance providers submit their liability and damage position in writing, along with supporting evidence, to an independent adjustor who reviews the documents and issues a final decision.

This method is popular among insurance carriers because it avoids the expense of litigation, including expert witnesses, depositions, and attorney fees. Most disputes arise because of inconsistencies between the damage and claim estimations from the different stakeholders. As stated before, manual inspections are subjective and thus lead to such issues.

Arbitration can be mandatory or voluntary, and this process can settle motor insurance liability claims. The arbitrator will determine the scope and extent of damages and who is responsible.

It is important to note that automobile insurance arbitration is not appropriate for every claim, however. For example, it cannot settle claims between automobile insurance companies involving collision coverage, comprehensive coverage, and other coverage types. It is also inapplicable for bodily injury claims.

As you can see, the relevance of repair estimates cannot be understated. There are many ways to get a fair repair estimate from your insurance company. First, it's important to remember that car repair estimates are based on a "best-case scenario" and are negotiable.

Additionally, they are subject to inter-company arbitration. However, if you are unsatisfied with the repair estimate you receive, you can file a dispute with the insurance company. They will handle your complaints and provide information on how to file an arbitration claim.

However, this approach involves time-taking dedication and multiple follow-ups, which are cumbersome and redundant. When auto insurers incorporate AI into their workflow, many associated issues with damage and claim estimations dissipate.

AI-based Estimation

According to a recent McKinsey report, 85% of executives stated they increased the digitalization of employee engagement and interactions during the pandemic. [Source: McKinsey] Whether you are an insurance adjustor, a risk manager, or an IT manager, AI is changing how claims estimations are processed.

The property and casualty industry thrives on capturing and analyzing data - from mobile devices to automobile IoT sensors. This data can help personalize customer interactions and identify issues. Using AI for insurance claims automation is a step toward this end. It requires a comprehensive library of information on each vehicle and the ability to analyze it quickly and accurately.

For example, AI-powered automatic inspection can help insurance companies evaluate salvageable parts and make total loss decisions. The AI-based vehicle inspection system is increasingly becoming more prevalent in auto insurance.

These systems aggregate vast amounts of data and reduce development costs while improving security, accessibility, speed, reliability, and scalability. While AI-assisted systems are a great way to improve processes, finding the right solution for your company is a crucial challenge.

Straight Through Processing for Motor Claims

Straight Through Processing, or STP, is a way to simplify auto claims processing and deliver fast and accurate results. STP uses artificial intelligence to assess a claim and make recommendations for repairs. It also allows insurers to remove the humans in the loop, which improves the overall experience for everyone involved.

A policyholder can quickly submit photos and data from a mobile app or web portal and generate a repair estimate. AI uses vast data sets of rules to make decisions and can improve its decision-making skills over time.

It can also free up claims handlers to focus on more complex and valuable tasks. As a result, straight-through processing increases speed and efficiency, reduces costs for carriers, and improves the customer experience.

AI is rapidly approaching a vital nexus for the insurance industry. A recent Accenture survey found that 79% of claims executives believed AI would significantly impact the insurance industry and generate value throughout the value chain. [Source: Accenture]

As machine learning relies on big data and automation, straight-through processing will streamline claims and help insurers reduce errors. Straight-through processing reduces errors, improves consistency, and drives faster settlement of claims.

How Does AI-based Estimation Work?

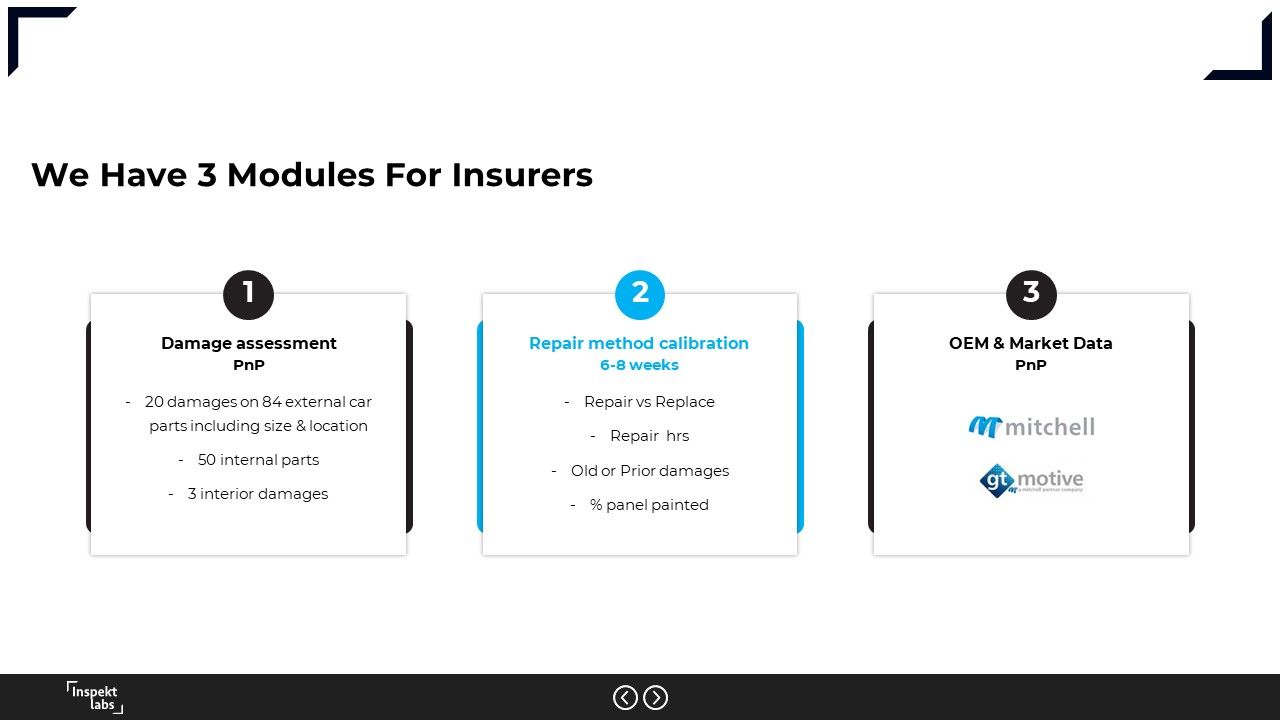

Let us look at how these estimations work. Insurers can utilize three primary modules for repair estimation, viz., i. damage detection, ii. repair method calibration, iii. OEM and market data. Let us discuss each module.

Damage Detection

AI claim estimation and damage detection is an emerging technology for insurance companies. The software works by analyzing images and recognizing damaged automobile parts. It can then evaluate the damage severity by comparing it to pictures of similar vehicles.

This feature of AI is a boon for insurers as it will save both time and money on claims. The factor that works in favor of insurers is universal damage detection. For example, a scratch sustained by a vehicle in London will not be different from a scratch in Tokyo. Therefore, the AI models trained for damage detection have a global appeal because they are applicable regardless of the location.

Damage detection and claim estimation are critical parts of the claims process. These systems must process massive amounts of sensitive data daily. These systems need large amounts of photos and videos of a particular vehicle to estimate damages accurately.

To use AI technology, these companies must license this data and have data annotators. In addition, data goes through categorization and segmentation. AI claim estimation and damage detection use machine learning algorithms to analyze photos of vehicles to assess damages.

The software allows experts to get instant damage vehicle condition reports and estimate repair costs. By using deep learning and AI, the technology can provide accurate information about the condition of vehicles and reduce costs associated with car repair. The system is suited for both stationary and mobile inspection systems.

AI-based damage detection and claim estimation help insurers improve customer experience and reduce employee expenses. It enables insurers to perform additional checks on claim declarations and repair quotes. In addition, AI-powered car repair detection and monitoring allow for faster claim settlements. The technology also helps to prevent fraud.

Repair Method Calibration

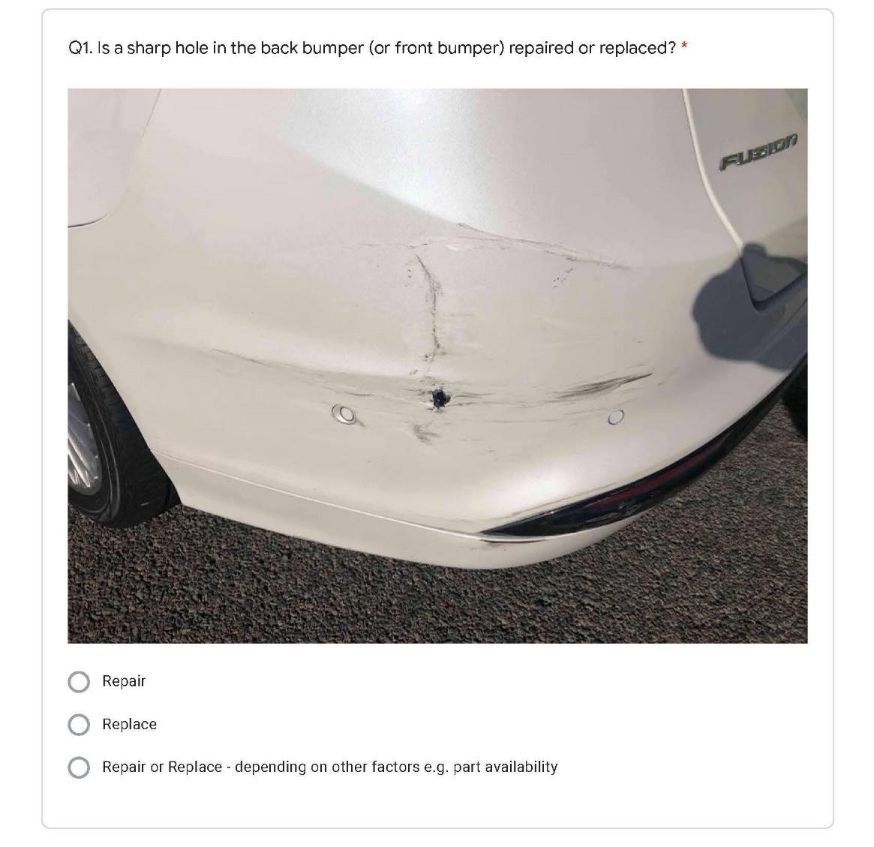

Repair methods are generally standard, but there are some variations. For example, a scratch is painted regardless of a vehicle's location. On the other hand, a sharp hold in the front bumper is generally repaired in the U.S. but replaced in some European markets.

Inspektlabs interviews the lead adjustor to calibrate the repair method using a survey questionnaire. The following are some examples of the type of questions that help us calibrate the repair method.

The following sample question directs the lead adjustor to determine how their company would handle a sharp hole in the front or back bumper of the car.

Let us consider another sample question that gives insight into the estimated repair time.

The responses from the adjustors can vary and heavily rely on the context. These questionnaires help us calibrate the repair estimates based on every company's standard practices.

OEM and Market Data

There are two facets to this module. The first is that Inspektlabs' AI inspector can read VIN or license plate and decode them to identify the model and make of the car.

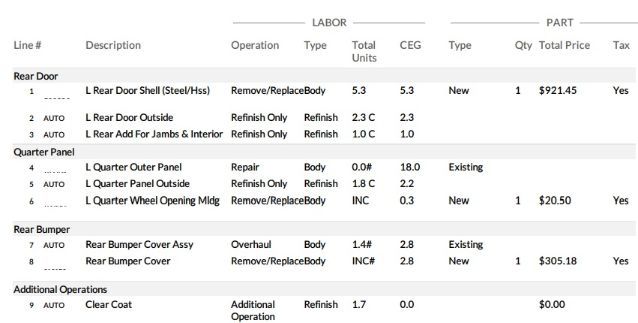

Then, integrations with OEM providers such as Mitchell (Press release) and GT Motive (Press Release) allow us to get the right part numbers, part prices, and repair methods. In some markets, we have gathered in-house pricing data as well. The following table illustrates a sample of some in-house data that we have.

Limitations of AI-Based Estimations

Since these modules are in the early stages of development, some limitations exist. There are two primary limitations of AI-based estimations, i.e., internal damages and old/prior damages.

- Internal Damages - Inspektlabs' AI can conduct Straight Through Processing (STP) or repair estimate automation only for small claims (bottom 20-30%). Mid-sized or large-sized claims have a lot of internal damage.

While it is possible to predict somewhat the probability of internal damages based on external damages, even an experienced adjustor cannot accurately predict internal damage. In many cases, the adjustor must dismantle the car at the garage. For example, in the image below, the car's front bumper has sustained heavy damage. Accurately predicting the exact scope and extent of the internal damage will not be possible without dismantling the front of the car in such cases.

- Old/Prior Damages - Another limitation is that mid-sized or large-sized claims may have damages on multiple sides of the car. With most insurers, you can only cover the most recent accidents, not the old ones.

However, customers often try to combine multiple accidents into a single claim. Inspektlabs predicts old/prior damage, but some subjectivity is involved. The insurance surveyor/adjustor typically talks to the customer and makes a subjective decision on whether the damage sustained is fresh or old.

How Does Inspektlabs Manage These Limitations?

- Inspektlabs' claims automation system tackles both the limitations mentioned above. We solve the internal damage limitation by focusing on small claims exclusively and predicting internal damage based on external damages for mid-sized and large-sized claims. Inspektlabs damage inspection framework concentrates on small claims first, starting with the bottom 5%, then moving to the larger ones.

- Inspektlabs' vehicle inspection software can also differentiate old/prior car damages from new ones to tackle the second limitation of old/prior damages. Let us consider an example. The model generated the following summary claim report for a test image.

The AI utilized the following set of images to generate the report.

In the images above, the front bumper damage seems unrelated to the primary damage on the right rear door. So, there is a high likelihood that the front bumper damage comes from an older accident and should not qualify for repair under the claim. The AI uses an 'old or prior damage' warning message (represented by a *) in the report to alert the adjustor.

Typical Workflow

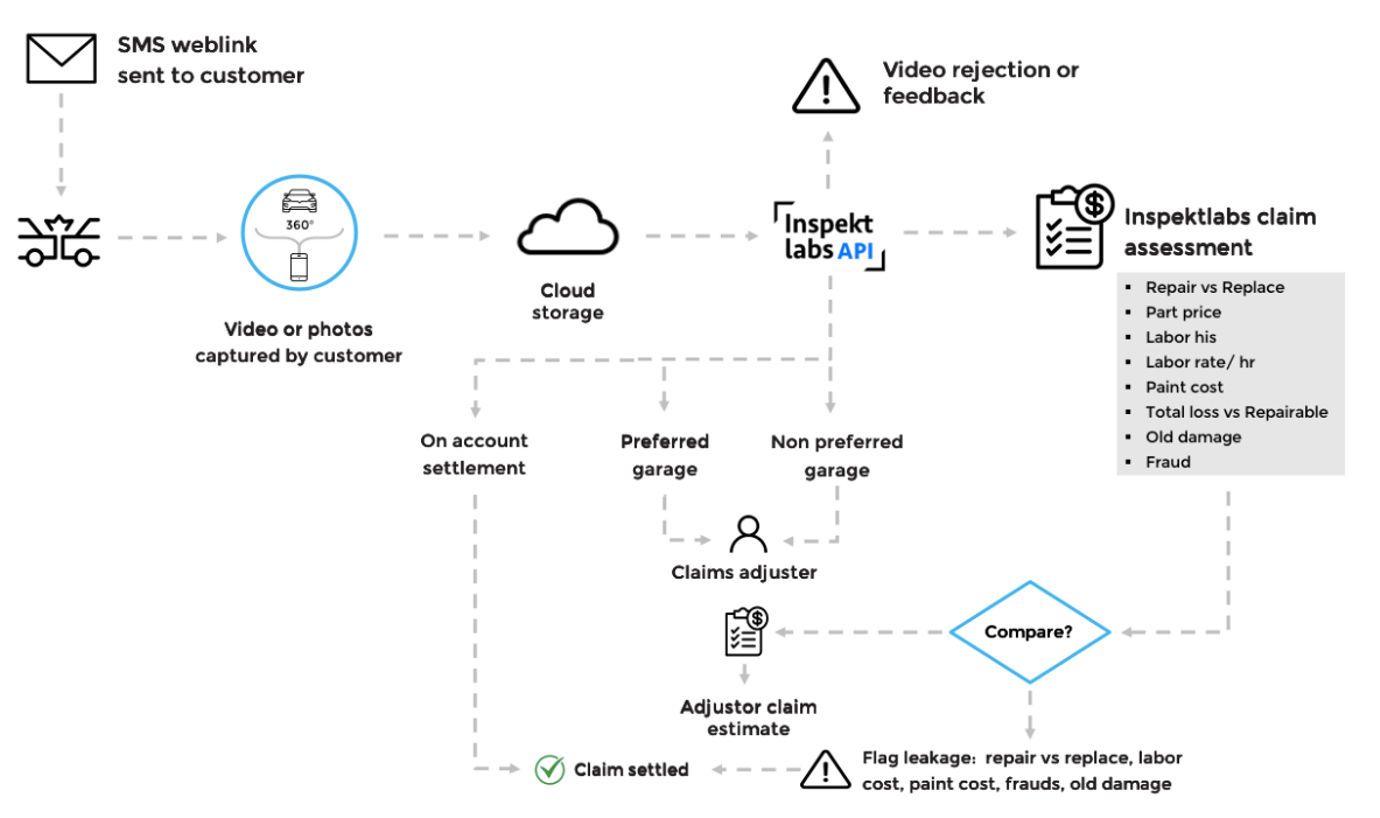

Let us now consider the typical flow for a repair estimation. Once a car sustains damage in a car accident, the customer receives a weblink to record a 360° video and photos of the vehicle.

This data is stored on the cloud and processed through Inspektlabs' API. Then, the API generates a claim assessment report that contains information such as repair vs. repair, part price, labor hours, labor rate, paint cost, total loss vs. repairability, old or prior damage, and fraud detection.

In some cases, the repair estimation may also be subject to a companion by a garage's claims adjustor to look for discrepancies or leakages in mid-sized or large-sized claims. Typically for small-sized claims, the entire process is automated without human involvement.

An excellent feature of this workflow is that it is malleable as per the needs of each insurer. The workflow is entirely customizable and adjustable according to the insurer's requirements, regardless of the complexity. The typical workflow is illustrated in the image below.

Results

Inspektlabs' partnerships with Mitchell and GT Motive enable AI claim estimation solutions to accelerate claims processing and improve policyholder satisfaction. Together, these collaborations provide a comprehensive claims management digital platform.

However, claim estimation is complex. Sometimes, the same adjustor can create two different estimates for the same photos at separate points in time. This inconsistency arises due to human subjectivity.

For example, a big dent in the front door could be repaired or replaced based on the surrounding context. Large claims have internal damages that cannot be accurately assessed with external damage photos and videos. So, as a result, we focus on small claims wherein subjectivity and internal damages are lower.

We start with windshield claims and single-panel damages. Since the damage is restricted to a single panel, the subjectivity is lower, and it is possible to automate the claim.

We have segregated claim assessments in three phases, viz. windshield claim only (3-5%), single panel minor damage (5-10%), and 2-panel minor damage claims (10-18%). So far, we have reached only ~10% claim estimation automation for most clients (phase 1 and phase 2). The remaining claims are partially automated.

Conclusion

There are millions of auto claims filed in the U.S. annually. Insurance companies can reduce the time and cost associated with the claims process by leveraging AI for repair estimation.

The average cycle time of a claim can be cut by days or even weeks. AI has the potential to make the entire process more efficient. AI is capable of analyzing images of vehicles and detecting the damages.

The AI can recognize the unique features of a particular car and rate damage severity accordingly. It can also be trained to recognize individual parts and assess the degree of damage. The AI algorithms can determine the repair cost in just a few seconds.

Many car insurance companies are beginning to adopt the technology. They can now resolve some claims with a simple interface, reducing the need for a human adjustor.