4 Challenges Motor Insurance Companies Need to Tackle | Inspektlabs

Digital transformations are becoming increasingly important for companies in many industries. The motor insurance industry is no exception, as it has long sought to modernize its data and application landscape, implement digital customer service, and integrate front-to-back functionality.

Some common issues trouble motor insurance companies across the United States. These include economic inflation, social inflation, and vehicle repair costs that are unpredictable.

There is also fraud within the vehicle repair network and the cost of reclaiming excess payments. Let to explore these critical issues in some depth. We will also analyze a few potential solutions that can address them.

1. Social Inflation and Economic Inflation

Social inflation is the increase in insurance costs due to societal and legal trends. This phenomenon can sometimes put insurance companies out of business, as they struggle to provide coverage to the most vulnerable people. In other cases, social inflation can push insurance companies out of business, resulting in out-of-reach renewals.

To avoid facing the consequences of social inflation, insurance providers must monitor trends in liability court awards and develop strategies to reduce risk. These risk factors may require rapid adaptation of business plans and relationships with business partners.

Economic and social inflation both affect data and can complicate forecasting. In some cases, the companies may choose to adjust their models to account for social inflation by including additional contingencies or conservatism in their forecasts.

In either case, the results of their models may be subject to further revisions. Regardless of the particular cause of each of these problems, understanding the strengths and weaknesses of data is essential to creating reasonable estimates.

Social inflation and economic are common challenges that insurers must face. The insurance industry is increasingly losing the battle against social inflation. While economic factors cause social inflation, the insurance industry is still fighting against it.

Managing social inflation is a complex task. The rising cost of claims is a problematic factor for motor insurance companies. The cost of claims is growing by double-digits annually, and the escalating societal sentiment contributes to this trend. The increasing cost of litigation is affecting insurers' profitability as the industry seeks to be more responsive to consumer concerns.

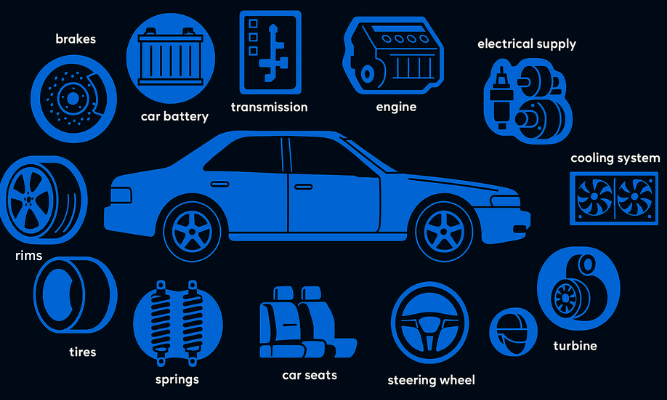

2. The Unpredictability Of Vehicle Repair Costs

Many customers distrust insurance companies due to the unpredictability of vehicle repair costs. Whether you are claiming damage to your car or another person's, getting an independent estimate of the repair cost is always a good idea before agreeing to pay a settlement.

Even if the insurance company's estimate is lower than the actual cost of repairs, it's always advisable to acquire an assessment before signing a contract. This way, the insurance company has no incentive to settle quickly.

While buying a new vehicle may be a good option if you are worried about a high repair bill, it is crucial to remember that it may not be your best financial decision. Rather than letting yourself be stranded, you might want to consider selling your current vehicle to avoid financial loss.

Aside from being more convenient, selling your car on your terms allows you to set the price. Therefore, accurate vehicle repair costs are a must-have.

3. Fraud In The Vehicle Repair Network

One of the most severe problems facing motor insurance companies is fraud. While fraud does not necessarily have a victim, some perpetrators may use the fact that the crime is victimless to justify their actions.

Many car insurance policies are fraudulent, with many consumers deceiving insurers to get the most out of their policies. These fraudulent claims often include exaggerating an accident's severity, staging an accident's scene, and filing false insurance claims.

Falsely staging auto accidents, including forcing another driver into a collision, is also common. Another scam involves partner-car theft. Sometimes, the stolen car is sold or destroyed, and the owner files an insurance claim.

Auto insurers lose billions annually in premium leakage caused by inaccurate information. Incorrectly reported mileage, unrecognized drivers, and violations/accidents contribute to this loss.

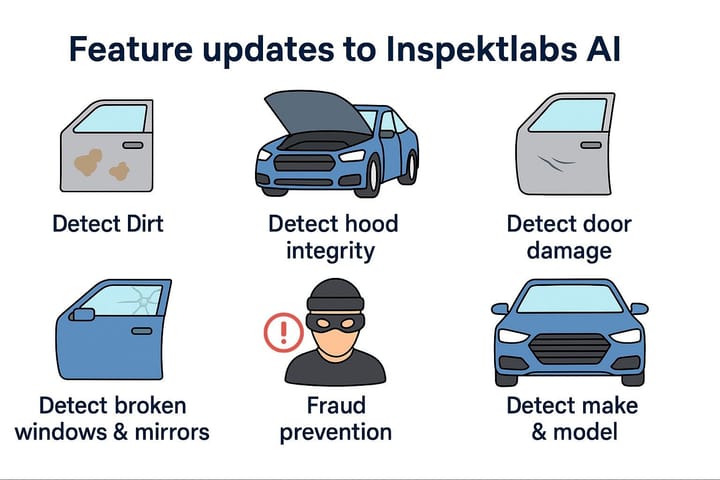

Luckily, the vehicle repair network fraud doesn't have to cost the insurance company a fortune. While preventing such financial losses is challenging, it is not impossible. Using new-age technologies like damage assessment automation with AI can help resolve this issue.

4. Inefficiencies in Risk Management

Reducing fraudulent claims has become crucial to insurance companies' bottom lines in the current environment of increased internet sales and the increasing complexity of auto insurance fraud. Incorrect claims cost insurance companies money and lead to increased rates.

Companies require highly experienced fraud analysts to generate a reliable vehicle inspection report for insurance claims. This approach is expensive and not scalable to larger claims volumes. Consequently, AI for vehicle inspection claims processing is the answer. But how can such an approach improve customer service?

AI as a Potential Solution

Companies risk losing good customers at renewal time without a reliable system to screen and separate fraudulent claims from legitimate ones. In contrast, AI damage inspections can detect fraudulent claims and quickly pay legitimate claims, thus reducing costs and increasing customer satisfaction.

The insurance industry is slow in adopting this new technology, but this could save them millions of dollars and hours of manual labor.

Auto insurers are facing a new era of competition. With consumers increasingly embracing digital channels, insurers have lagged in adopting. Yet, the Covid-19 pandemic has forced many laggards to adapt. The rise of InsurTech companies is accelerating the adoption of new technologies.

InsurTech companies like Inspektlabs target traditional insurers' pain points, while insurance-as-a-service vendors work to improve inefficiencies and disrupt incumbent players. New-age companies are upending the existing insurance industry by forcing them to adopt digital technologies and launch easy-to-use products.

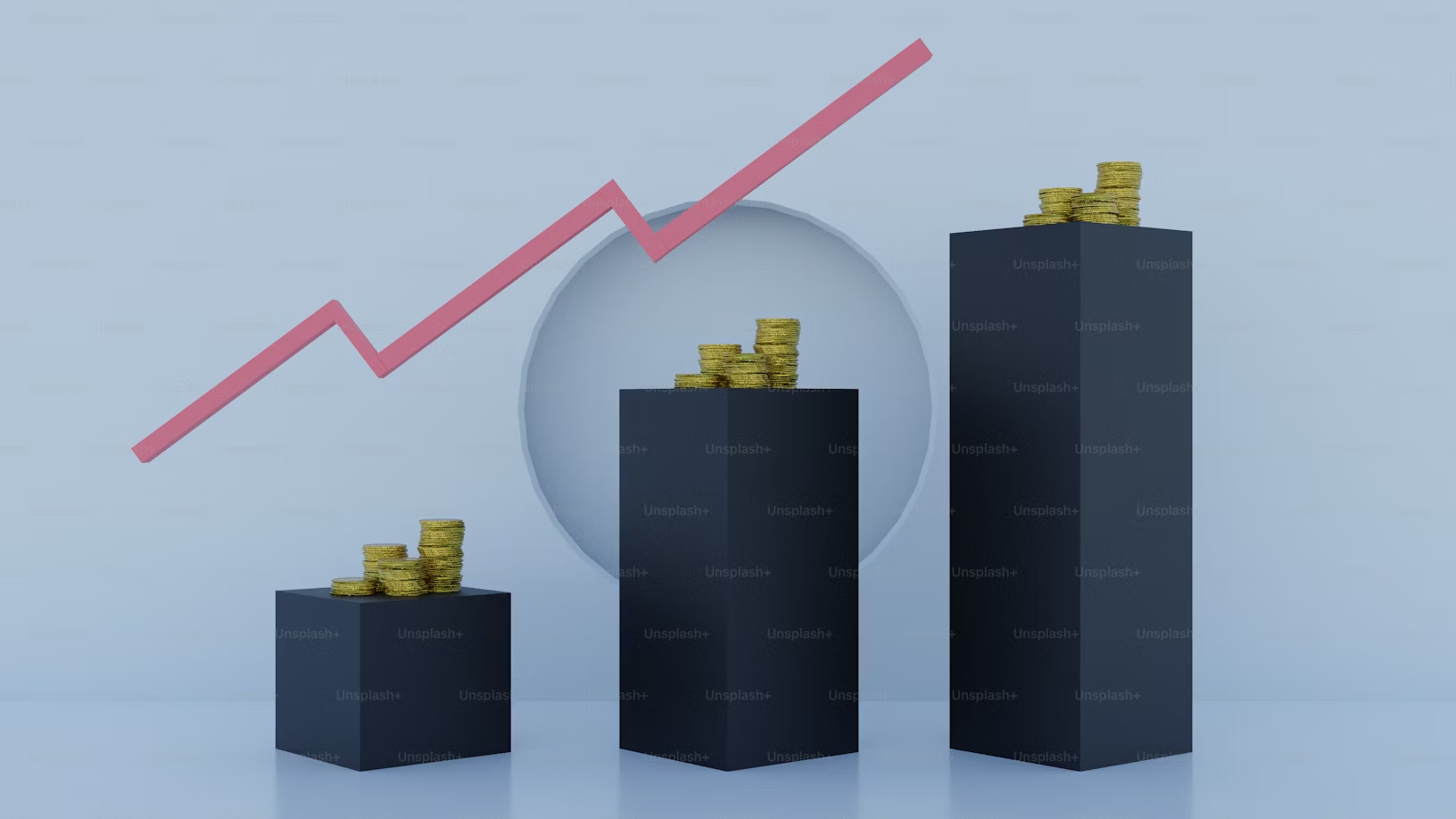

InsurTech companies have emerged to address these needs. InsurTech startups and technology consulting companies fuel this growth. . By 2030, the Insurtech industry is anticipated to be worth $114 billion, increasing at a CAGR of 46.1%. [1]

Advantages of Artificial Intelligence

Auto insurance companies should invest in AI to deliver a digitally driven customer experience. As automation continues to increase, insurers should embrace AI. The technology can streamline many processes, including claims handling, fraud detection, and data processing.

Efficient Claims Processing

AI can provide many benefits for insurers, including improved customer service, claims processing, and around-the-clock customer service. For example, AI can analyze photos to assess the extent of damage and predict the cost of repairs.

With mobile data linked to powerful AI, insurers can provide policyholders with information about local repair facilities. Additionally, insurers can offer policyholders information about the cost of repair services to get a better estimate ahead of time. Companies can offer a vehicle damage inspection app to facilitate these services.

Predictive Modeling

AI needs constant training and access to new data. AI must constantly account for recent behavior changes to accurately predict the future. InsurTech companies are already beginning to take innovative approaches to this problem.

Some have launched venture capital arms and formed partnerships with leading academic institutions. As companies start to understand the capabilities of AI, they can determine which strategies will work best for their business.

Mitigating Risk

AI algorithms are also helping insurance claims organizations monitor risk by integrating new data sources and AI. Once a certain threshold hits, AI will initiate interventions based on collected data.

Depending on the type of risk, insurers can pre-file a claim before it occurs. AI algorithms can also help auto insurers identify car accidents and automate the appraisal process, producing "touchless" estimates. All these benefits can help insurers increase their efficiency and reduce their claims cycle time.

AI can also reduce the risk of financial security errors. Manual claim verification processes are time-consuming, error-prone, and ineffective. Insurance companies can automate this claim assessment and free insurance agents to do other, more complex tasks.

Furthermore, AI will improve the customer experience. AI-powered chatbots can answer policyholder questions around the clock, and ML algorithms process claims instantly. Ultimately, AI can improve the overall customer experience.

Agility

Today's consumers expect transparency, speed, and ease of use regarding the products and services they need. To meet these demands, many insurers are turning to artificial intelligence (AI)-powered platforms to replace human input and automate processes like policy generation.

In the same way, chatbots can answer customer queries and recommend products based on a policyholder's risk profile. Insurers are employing this direct insurance digital strategy to cut out the middlemen agents and offer lower rates.

Insurers must move quickly to stay competitive in today's market. VC investments in Insurtechs topped $11 billion in 2021, more than double that in 2020. [2] While the insurance industry is not yet at the forefront of digital transformation, new players and customers with high expectations are forcing the industry to become more agile.

With the growing adoption of digital technology, insurers must become more responsive to their customers. They must create innovative mobile apps and harness big data's power to understand their customers better.

Insurers must leverage AI to transform their business. Big data, including customer data, is the foundation of innovation. If the insurance industry can harness the power of data, insurers can streamline their core operations and launch new business models.

Ultimately, it is about improving the customer experience, starting with data. Using data and analytics is the key to success. You will see your bottom line improve if you can use data effectively.

AI-driven tools, like damage assessment automation with AI, can help insurers reduce their costs and increase customer satisfaction. For instance, blockchain-powered smart contracts allow insurers and customers to collaborate while sharing data anonymously.

Blockchain technology can help insurers identify blind spots in fraud detection. Smart contracts also help speed up the claims process on parametric insurance products. Further, blockchain-powered systems can improve customer service by reducing claims time. The speed of claims and fraud detection improves exponentially using vehicle inspection automation and other digital tools.

Conclusion

Digital transformations are becoming increasingly important for companies in many industries. The motor insurance industry is no exception, as it has long sought to modernize its data and application landscape, implement digital customer service, and integrate front-to-back functionality.

A modular approach can help insurers achieve these goals with minimal investment and configuration. This factor can also facilitate the implementation of new products and services, enabling the insurance industry to leverage the latest technological developments.

References:

[1] Straits Research, 2022, Insurtech Market: Information by Type (Auto, Home), Service (Consulting, Managed Services), Technology (Blockchain), End-User (Automotive, BFSI), and Region — Forecast till 2030.

[2] Irlbeck, Christian, et al. McKinsey & Company, 2022, How Insurtechs Can Accelerate the next Wave of Growth.