6 Advantages of Insurance Claims Automation | Inspektlabs

Automating the claims settlement process is prudent for all insurers and businesses. There's little doubt that these technologies will become the norm—automation benefits not only companies and insurers but also customers.

This post will cover some of the advantages of insurance claims automation. We will begin by briefly introducing automation in the insurance industry before discussing its benefits. First, we will evaluate how automation improves the customer experience while reducing costs. Then, we will cover how automation optimizes recourses, increases lead conversions and expedites claims processing. Lastly, we will cover how automation enables fraud detection before concluding.

Introduction

It isn't easy to imagine an industry where automation is not making a revolutionary impact already. The automotive insurance industry is no exception since it is experiencing some of the most impactful changes. The introduction of new-age technologies, such as artificial intelligence, is revolutionizing the claims processing framework. From improving the customer experience to reducing costs for auto insurers, automation accelerates the industry's growth. Let us look at the different aspects in which automation boosts the insurance claims process.

1. Better Customer Experience

Historically, insurance businesses have had limited direct interactions with customers. Today, customers expect insurance companies to deliver seamless experiences across all customer touchpoints. Among the various customer interactions, the claims process is an important one.

- Once businesses automate the claims process, they can improve efficiency by allowing customers to submit claims online, map policies against predicted events, or offer product recommendations based on their browsing habits. Customers will be happier with the claims process and more likely to renew their policies. These goals are achievable through leveraging claims tech.

- These solutions include apps, chatbots, and other customer engagement technology. These tools can also improve overall customer satisfaction. The claims process is among the most critical events in a policyholder's life, so customers want quick service, diligent follow-ups, and a personalized experience. Insurance companies can improve the claim process by providing proactive status updates, allowing them to deliver a positive customer experience.

2. Reduced Costs

Whether you're looking to improve your claims processing operations, reduce costs, improve customer satisfaction, or enhance operational efficiency, several solutions can help you meet your objectives.

- Robotic Process Automation (RPA) is a technology trend that uses artificial intelligence to emulate rules-based processes. It can automate tasks such as claim verification and error tracking, saving time and money. RPA can also be used to streamline workflows, which can help insurers achieve multi-layer efficiency.

- Insurers are also looking for ways to leverage automation to enhance customer satisfaction. They can use automation to improve the customer experience, increase transparency, and reduce fraud. They can also improve service standards and increase profits. One approach entails using artificial intelligence to take over tasks such as collecting basic customer information. They can then use the data to create new business models or improve the service of existing customers.

3. Higher Lead Conversions

Whether you are in insurance or have a small business that needs to process claims, it's crucial to find ways to reduce your costs, optimize your resources and ensure that your customers have the best experience possible. Insurance Claims AI is one solution that can help improve these areas and reduce the time spent on each claim. By incorporating these solutions into your workflow, you will improve your lead conversions since customers will not have to spend much time receiving evaluations or processing their claims.

4. Faster Claims Processing

Whether it's a new customer application, claims processing, or an audit of a claim, the insurance claims processing process can be made faster and more efficient with the help of automation.

- Automated claims processing software can help you automate tasks, improve customer experience, and decrease costs. Automating tasks helps reduce the number of errors in data entry and the overall claims process. These errors can have a significant impact on your business. Automating tasks that require manual labor will also reduce your staffing costs. This factor can also improve employee satisfaction. Repetitive tasks can also lead to human error. In addition, manual work tends to be tedious and taxing on human agents.

- Automating tasks such as data entry can reduce the number of mistakes and save the company money. The process can also reduce back office functions, resulting in faster claims processing. Insurance claims processing has traditionally involved manual tasks, and there's always a potential for errors and discrepancies in the manual process. With claims automation, you will drastically limit the scope for human error.

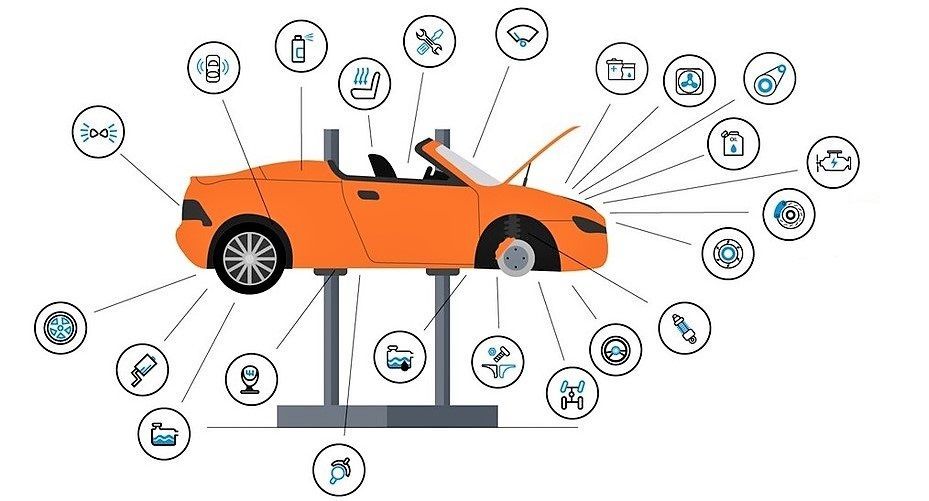

5. Optimizing Resources

AI in insurance claims processing helps ensure that businesses do not dedicate their resources to trivial or standard cases. Creating an optimized claims processing environment can help insurance companies meet customer expectations and improve productivity.

- The process includes mapping the customer journey and automating the proper steps. But it is also essential to balance process automation with human support. A customer journey map can provide insurers with critical insights into claims. It can also identify opportunities to optimize processes. Intelligent processes promote customer satisfaction, reduce losses, remediate fraud, and empower employees.

- Automating claims can expedite handling operations by making them streamlined and reducing costs. Automation can free up claim handlers and reduce manual labor. This reduces friction from unnecessary touchpoints, resulting in greater customer satisfaction. Human agents can also become available for more pressing issues and dedicate their time and energy to more complex cases.

6. Fraud Detection

The introduction of automation in claim assessment can also enable fraud detection. Insurance fraud is a significant issue facing all insurance providers. Any fraud, no matter how little, can escalate and become exceedingly costly. Consequently, companies must exercise extreme caution while reviewing every claim throughout settling insurance claims.

- Since it is physically impossible to check every claim manually, the insurance claims technology, such as that facilitated by Inspektlabs, may assist insurance firms in identifying fraudulent behaviors and tendencies. In such situations, the triggers might repeatedly be submitting claims or a lengthy rejection history of claims, among other things. When insurance companies pool together high-risk customer profiles based on shared features, they can better monitor future claims made by policyholders to detect and prevent fraudulent activity. After completing the necessary permission steps, AI-powered engines can provide access to the claim settlement process securely.

- Policyholders may also set up biometric authentication to safeguard them against identity theft rather than relying on old-fashioned security techniques such as passwords and one-time passwords (OTPs), which are vulnerable to attack. Consequently, they may employ unique identifiers like fingerprint, voice, or iris scans to make a claim. All these features are possible through leveraging automation.

Conclusion

Automating the claims settlement process is prudent for all insurers and businesses. There's little doubt that these technologies will become the norm—automation benefits not only companies and insurers but also customers. There are many ways in which automation can positively impact the insurance claims process, and these impacts will magnify as the technology continues to improve.